Cash Flow Hedge Vs Fair Value Hedge

Ad Make Market Volatility Work to Your Advantage. It also covers a highly probable forecast transaction.

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

Declining bond interest expense.

. A cash flow hedge is a hedge derived from cash flows received from two or more. A fair value hedge is used to hedge the risk of an asset such as stock or inventory. On the other hand a fair value hedge is a type of hedging instrument designed to limit exposure to changes in the value of an asset or liability.

View CASH FLOW VS FAIR VALUE HEDGEdocx from FIN 2 at Blue Mountains Hotel School. Learn What EY Can Do For Your Corporate Finance Strategy. There are several types of hedges but for todays discussion we will use only two cash flow hedging and fair value hedging.

View Cash flow Hedges Vs Fair Value Hedgesdocx from FINANCE PRINCIPLES at The Allied College of Education Gujranwala. Thats a cash flow hedge since it directly involves cash flows. Ad 0 Commissions Online Specialized Trade Platforms Satisfaction Guarantee.

Ad An Evolved System For Alternative Investing. Trade your view on equity volatility with Mini VIX futures. Fair value hedges can be used to hedge against the value of inventories the value of a fixed.

This lesson will focus on cash flow and fair value hedges. Start studying Cash Hedge vs. Ad An Evolved System For Alternative Investing.

A cash flow hedge is defined as an instrument that lowers exposure to variability to future cash flows from a. On the other hand a. Learn vocabulary terms and more with flashcards games and other study tools.

It covers future interest payments on a variable-rate debt. 7y CPA US Exactly. Ad QuickBooks Financial Software.

Fair Value hedge is to hedge an asset you have currently like inventory etc where youre trying to protect the value in case the FV drops on. Fair Value Hedge VS Cash Flow Hedge The hedges illustrated above are fair value hedges. Which of these risks would best be protected by a fair value hedge.

For example if your company. The fair value hedges are the derivative contracts that will move in the opposite direction of the hedged asset. Ad EY Corporate Finance Consultants Help All Types of Businesses with Key Financial Issues.

A cash flow hedge is a hedge of the exposure to variability in. Feb 28 2016 1140AM EST. This is done so that the derivative contract can be used to cancel out your.

The requirement is that such cash flows should affect the profit. Differences Between Cash Flow Hedges and Fair Value Hedges. Cash flow fixed rate debt is not a cash Fair Value.

Rated the 1 Accounting Solution. Declines in inventory values. When hedging the changes in cash flow from assets and liabilities you are using what is called a cash flow hedge.

CASH FLOW VS FAIR VALUE HEDGE. View Fair Value Hedge VS Cash Flow Hedgepdf from ACCA 112 at Ateneo de Naga University. Fair value hedges on the other hand help to mitigate your exposure to.

Cash Flow Hedges Vs Fair Value Hedges 1 Cash Flow. Should the market decline the losses on the stock should be offset by gains on the puts. Cash flow and fair value hedges are two types of this derivative.

With a cash flow hedge youre hedging the changes in cash inflow and outflow from assets and liabilities whereas fair value hedges help to mitigate your exposure to changes in the value of.

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

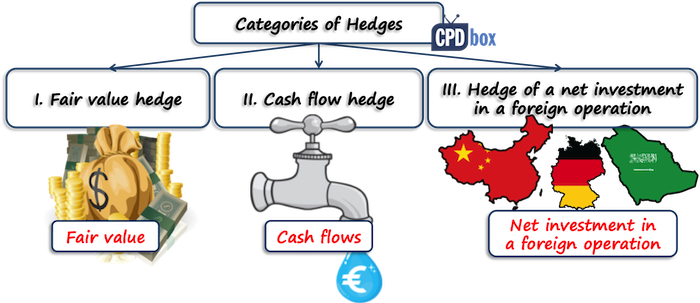

Difference Between Fair Value Hedge And Cash Flow Hedge Cpdbox Making Ifrs Easy

How To Determine Fair Value Hedge Or Cash Flow Hedge Under Ind As 109

Cash Flow Hedge Vs Fair Value Hedge Ppt Powerpoint Presentation Pictures Guidelines Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

No comments for "Cash Flow Hedge Vs Fair Value Hedge"

Post a Comment